CLASS-6

SIMPLE INTEREST

SIMPLE INTEREST -

Simple interest is a method of calculating the interest on a loan or an investment. It is a straightforward way of determining the interest earned or paid over a specified period of time. In simple interest, the interest is calculated only on the initial principal amount (the original sum of money borrowed or invested), and it remains constant throughout the entire duration of the loan or investment.

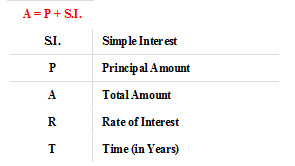

The formula for calculating simple interest is:-

Simple Interest (SI) = Principal (P) × Rate (R) × Time (T) / 100

OR

Rate (R)

Simple Interest (SI) = Principal (P) X ----------- X Time (T)

100

Where:

- Principal (P) is the initial amount of money borrowed or invested.

- Rate (R) is the interest rate per time period (usually per year) as a percentage.

- Time (T) is the duration for which the interest is calculated, usually expressed in years.

The result of this formula gives you the total amount of interest that will be earned or paid over the specified time period. It's important to note that in simple interest, the interest amount remains constant over time and is not reinvested or added back to the principal.

For example, if you borrow $1,000 at a simple interest rate of 5% per year for 3 years, the calculation would be:-

SI = 1000 × 5 × 3 / 100 = $150

OR

5

SI = $1000 X ------ X 3 = $(10 X 15) = $150

100

So, the simple interest over 3 years on a $1,000 loan at 5% interest rate would be $150. The total amount to be repaid would be the principal ($1,000) plus the simple interest ($150), resulting in a total repayment of $1,150.

The formula for calculating simple interest is:

Simple Interest= Principal × Rate × Time

Where:

- Principal:- The initial amount of money or the original sum of money that is borrowed or invested.

- Rate:- The rate of interest, usually expressed as a percentage per unit of time (e.g., per year).

- Time:- The time period for which the interest is calculated, often measured in years.

The resulting simple interest value is the additional amount that needs to be paid on top of the principal, or the amount earned on top of the initial investment, depending on whether you're borrowing or investing money.

Keep in mind that simple interest doesn't account for compounding, which is the process where interest is added to the principal, and subsequent interest is then calculated based on the new total. Simple interest is commonly used for short-term loans or investments where compounding effects are negligible. If the interest compounds, more complex calculations like compound interest formulas would be used to account for the changing principal over time.